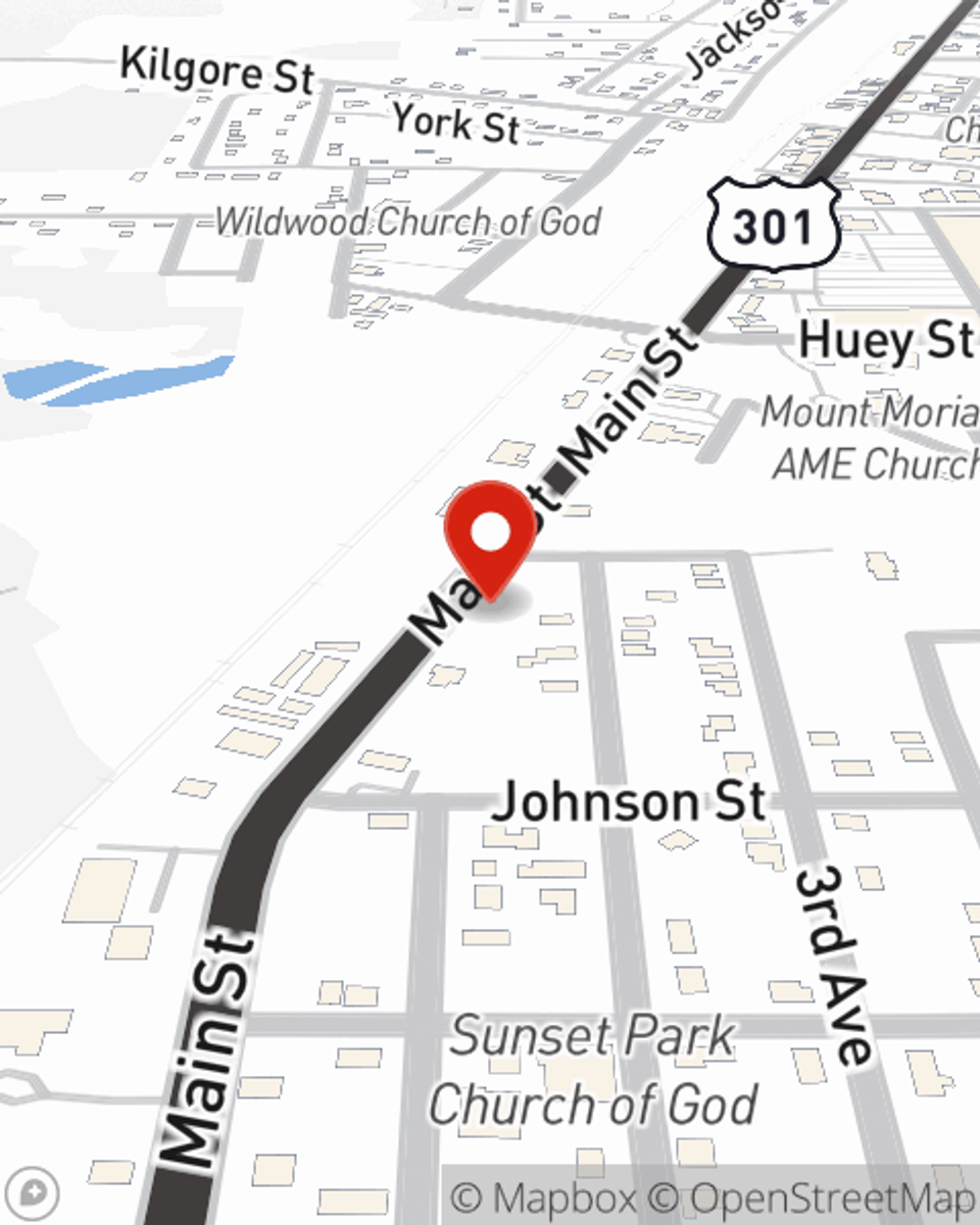

Condo Insurance in and around Wildwood

Townhome owners of Wildwood, State Farm has you covered.

Protect your condo the smart way

Your Belongings Need Coverage—and So Does Your Condominium.

There are plenty of choices for condo unitowners insurance in Wildwood. Sorting through deductibles and savings options can be overwhelming. But if you want great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Wildwood enjoy unbelievable value and straightforward service by working with State Farm Agent Nathan Thomas. That’s because Nathan Thomas can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as home gadgets, videogame systems, clothing, cameras, and more!

Townhome owners of Wildwood, State Farm has you covered.

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Nathan Thomas can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

As a commited provider of condo unitowners insurance in Wildwood, FL, State Farm aims to keep your belongings protected. Call State Farm agent Nathan Thomas today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Nathan at (352) 748-5272 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Nathan Thomas

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.